what are common stock warrants

Just like an option a stock warrant is issued with a strike price and an expiration date. Stock Warrants Journal Entry.

Month To Month Lease Meaning Pros Cons And More In 2022 Financial Management Lease Finance

The warrants come with an expiration date.

. A warrant is a financial instrument issued by companies in exchange for an expense or payment. A stock warrant gives holders the option to buy company stock at a fixed price the exercise price until the expiration date and receive newly issued stock from the company. The warrants will trade on either the NYSE or the Nasdaq and we provide you with all symbols and detail necessary for you to make an informed decision as to which warrants if any to purchase.

Each share of common stock and accompanying common warrant are being offered at a combined public offering price of 100 less underwriting discounts and commissions and each pre-funded warrant. A stock warrant should not be confused with a stock option as a stock warrant is directly issued by the company to the investor while a stock option is a contract between two people. Shareholders who receive rights and warrants have four options available to them.

Leverage or at least potential leverage is the prime reason an investor would be interested in warrants. Options Basics ebook shares a simple tactic that reveals when NOT to trade more. The two main rules to account for stock warrants are that the issuer must recognize the fair value of the equity instruments issued or the fair value of the consideration received whichever can be more reliably measured.

Usually the underlying security is an equity instrument which can be a companys common stock. Call warrants are most common and are what were generally talking about when we discuss warrants. Jeff Baker has been with common stock warrants for 10 years and brings a host of technical and scientific analysis to the team.

Both the warrants and the options eventually expire if they are not exercised by a. A business may pay a provider of goods or services with stock warrants. The chart below is a 6-month comparative chart of the common shares and warrants.

Stock warrants like stock options give investors the right to buy via a call warrant or sell via a put warrant a. Therefore when a company issues put warrants it is agreeing to purchase its own stock from the investor at a certain price. And recognize the asset or.

A stock warrant gives the holder the right to purchase a companys stock at a specific price and at a. If a stock is trading at. Similarly a call option gives the investor the right to buy a stock at a specified time and price while a put option gives the right to sell at a specified.

A stock warrant is a contract that lets you buy or sell shares of a companys stock at a specific price on a specific date. The strike price is the price at which the warrant becomes exercisable or in the money. When two companies decide to merge it is usually rather straight forward as to how much shareholders of the company being acquired will receive either in cash or in shares of the acquiring company.

Hold their rights or warrants for the time being. Warrants do not carry an obligation though. A convertible bond is a type of fixed-income debt security that a company issues to raise capital.

The Warrant Report July 20 2011 Warrants in Mergers Whats the Deal. The Warrant Report By Common Stock Warrants. A common stock warrant is a security that gives you the right to buy a stock at a specific price.

A put warrant gives an investor the right to sell the stock. Stock warrants are often used in conjunction with convertible bonds. This more rapid growth in the value of the warrant relative to the common stock is called leverage.

Investors around the world with access to trading on the NYSE and Nasdaq will be able to purchase these trading warrants. It gives the investor the right to. This prospectus supplement is filed solely for the purpose of including selling shareholders who have acquired shares of our common stock par value 00001 per share the Common Stock and Common Stock issuable upon the exercise of warrants each exercisable for one share of Common Stock at a price of 1150 per share Warrants.

Warrants are similar to the options but with one critical difference. A warrant is issued by the company that issues the stock. Stock warrants are the option that company provides to the investors to purchase the share at a specific price at a specific time.

These instruments involve the right to buy or sell a security in the future. A company may issue a warrant to attract more investors for an offered bond or stock. Ad Youre starting to trade options because options can be more lucrative than stocks.

Another alternative a warrant holder has is to sell the warrants. The shares that the investor acquires when they exercise a warrant doesnt come from public markets but rather from the company itself. For example when the company shares trade at 100 each and the warrants are 10 each more investors will exercise the right of a warrant even if they lack enough capital to buy.

What Are Stock Warrants. Investors with less capital can potentially buy more shares. Stock warrants are an alien concept to many investors but for seasoned investors they can be one of the most lucrative ways to invest in a.

The commons candles had a 15250 return during the 6-month period while the warrants for provided investors. But theres a catch. Purchase additional rights or warrants in the secondary market.

Stock Warrants vs. It provides the right to the investors but not the obligation to purchase the share. The essence of the answer is that the anticipated gain on the warrant must be greater than the anticipated gain on the common stock.

As a result the company may obtain better terms on the bond or stock offering. Warrants tend to be cheaper than common stocks. How to Account for Stock Warrants.

Warrants can be bought and sold up until expiry. A stock warrant is a contractual agreement between a company the issuer and an investor the holder. For starters recall that a stock option is a contract between two parties and gives the.

In depth research into mining companies is a natural fit as an Economic Geologist and long term experience in financial and technical markets allows for that analysis to be equally effective on the timing and structure. A stock warrant is similar to its better-known cousin the stock option. The predetermined price is the strike price.

Deal Toys Financial Tombstones Prestige Custom Awards Custom Awards Tombstone The Prestige

Solid Power To Trade On Nasdaq As Sldp After Completing Nasdaq Power Trading

Convertible Bonds Vs Warrants Meaning Differences Bbalectures Convertible Bond Business Articles Bond

Common Stock Valuation Security Analysis Two Basic Approaches Common Stock Business Articles Finance

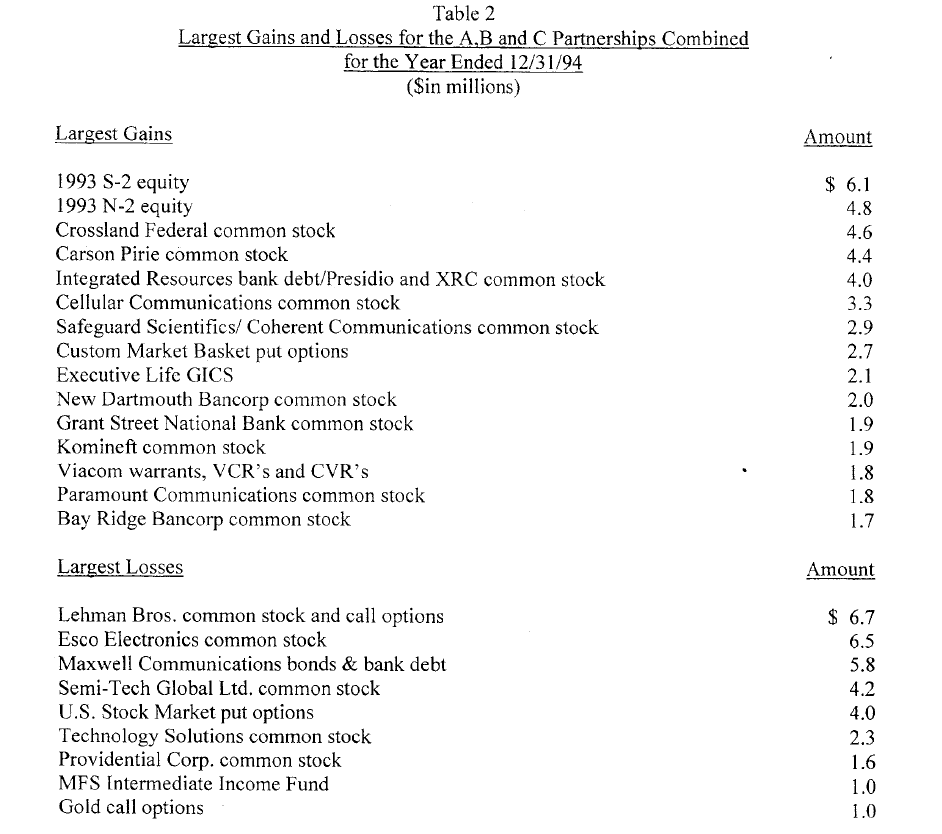

Lessons From Baupost Group S 1994 Letter Lettering Lesson Value Investing

![]()

Common Stock Warrants Infographic Common Stock Science Infographics

Triangle Shaped Crystal Tombstone Triangle Shape Crystals Preferred Stock

Difference Between Warrants And Convertibles Investing Financial Management Common Stock

What Is Cagr And How It S Useful Finance Investing Financial Management Business Basics

How To Calculate Diluted Eps Financial Analysis Basic Concepts Financial

Arrearages Meaning Example Uses And More In 2022 Accounting And Finance Financial Management Meant To Be

Common Stock Warrants Infographic Common Stock Science Infographics

Buy And Sell Cryptocurrency With Coinbase Cryptocurrency Money Advice Forbes